Investing#

https://www.menti.com/alohp2v13yqh

Before investing#

Payoff debts

Build emergency funds (General rule: Be able to cover 3-6 months of expenses)

Investing versus saving#

Liquid versus non-liquid assets#

How quickly can I cash out my investment/assets?

Are there any penalties/fees for early withdrawl?

Investing options#

Standard investment options#

Savings

Money Market

Certificate of Deposit (CD)

High Yield Savings Accounts (HYSA)

Bonds

Stocks (Index Funds)

Real estate

Speculation (risky investments)#

Lottery

CryptoCurrency

Individual stocks

Meme stocks (Gamestop)

Stock options

How & where to invest (keep it simple)#

Company investments

401K

Employee Stock Purchase Plans

GWU investment options

GW 403(b) Supplemental Retirement Plan

GW 401(a) Retirement Plan for Faculty and Staff

GW 457(b) Deferred Compensation Plan & GW 457(f) Restoration Plan

HSA

Online broker (Vanguard, Schwab, Robinhood, etc.)

target age retirement fund

index funds

ETFs (groups of stocks)

traditional & roth IRAs (tax benefits)

actively managed funds (beware)

Robo advisers (automated allocation and diversification offered by many online brokers)

Certified Financial Planner (CFP)

Free money (Yes you heard that right)#

Company benefits

401k matching

403(b) with 401(a) funding plus matching

Employee Stock Purchase Plan discounts

Tuition Remission & Exchange

HSA and other tax free options

Dependent Daycare

For advanced users only

Gaming the system with reward credit cards

GWU benefits links#

Investing strategies#

Diversify

Low or no fee index funds

Be wary of investment advisers

“Past performance does not guarantee future results”

Invest early and often (more compound interest magic)#

Set it and forget it#

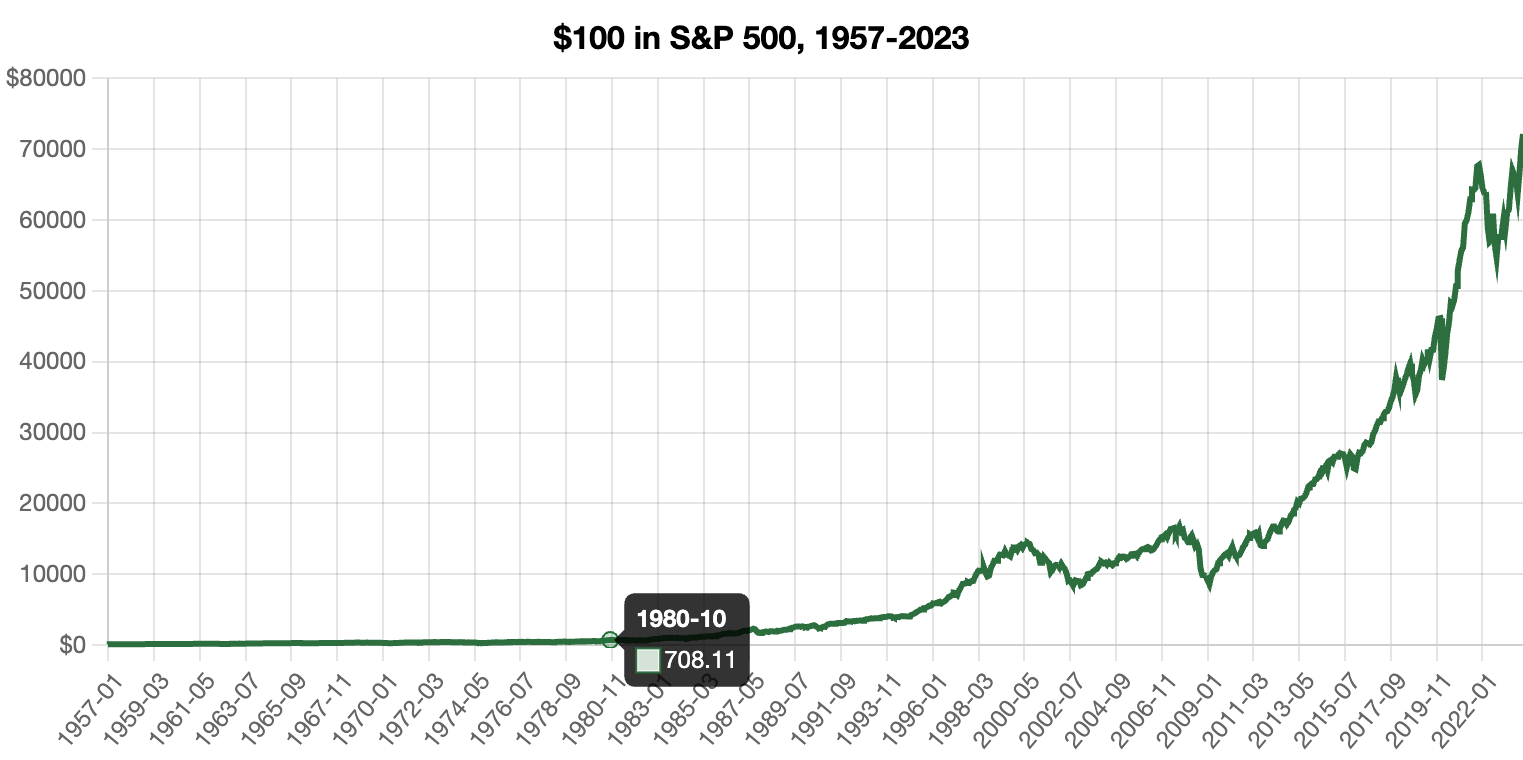

S&P 500 Invest \(\$\)100, 1957-2023#

If you invested \(\$\)100 in the S&P 500 at the beginning of 1957, you would have about \(\$\)72,148.05 at the end of 2023, assuming you reinvested all dividends. This is a return on investment of 72,048.05%, or 10.32% per year.

This lump-sum investment beats inflation during this period for an inflation-adjusted return of about 6,553.58% cumulatively, or 6.47% per year.

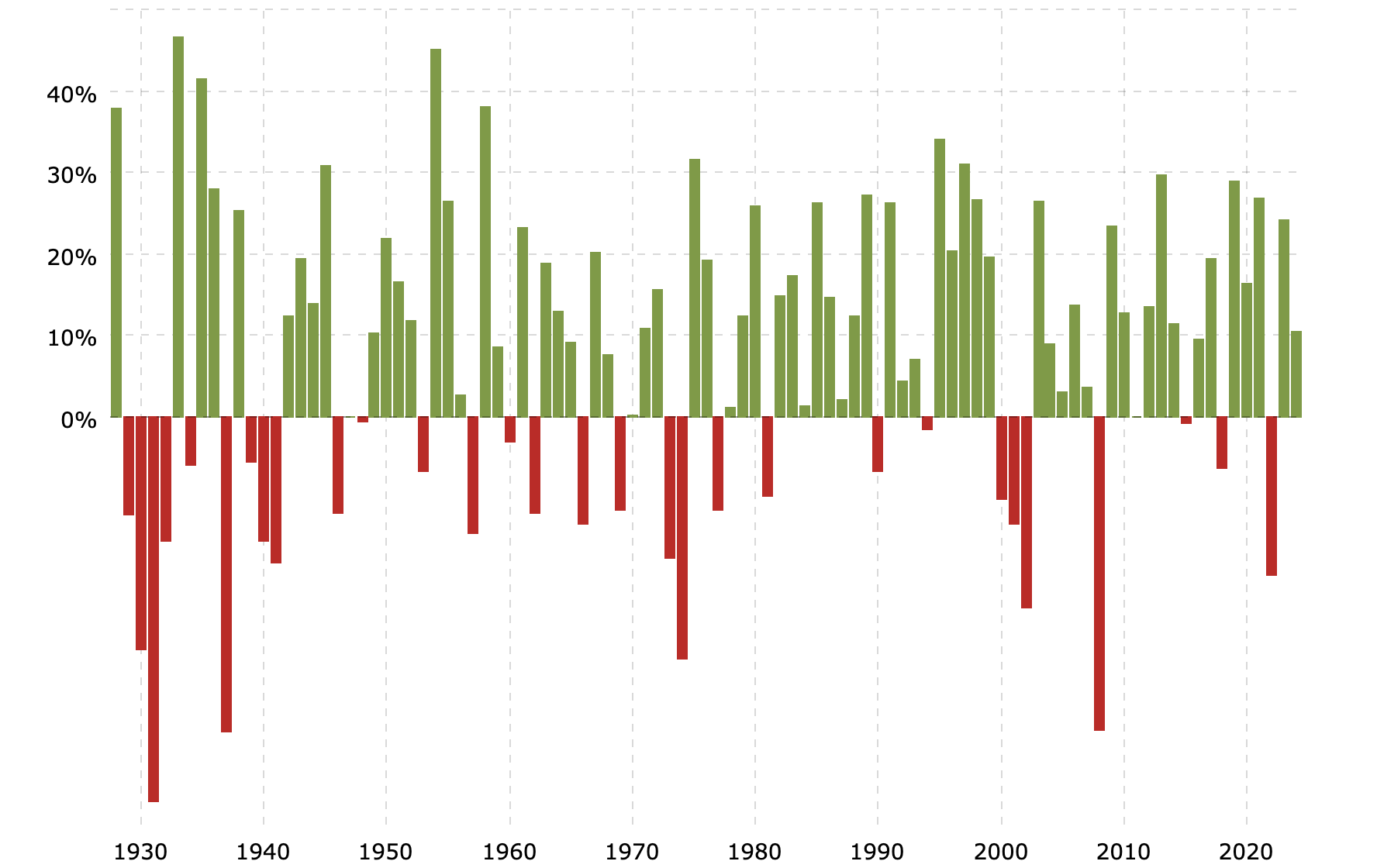

S&P 500 Historic Chart#

S&P 500 Historic Annual Returns#